💡 What is Simple Interest?

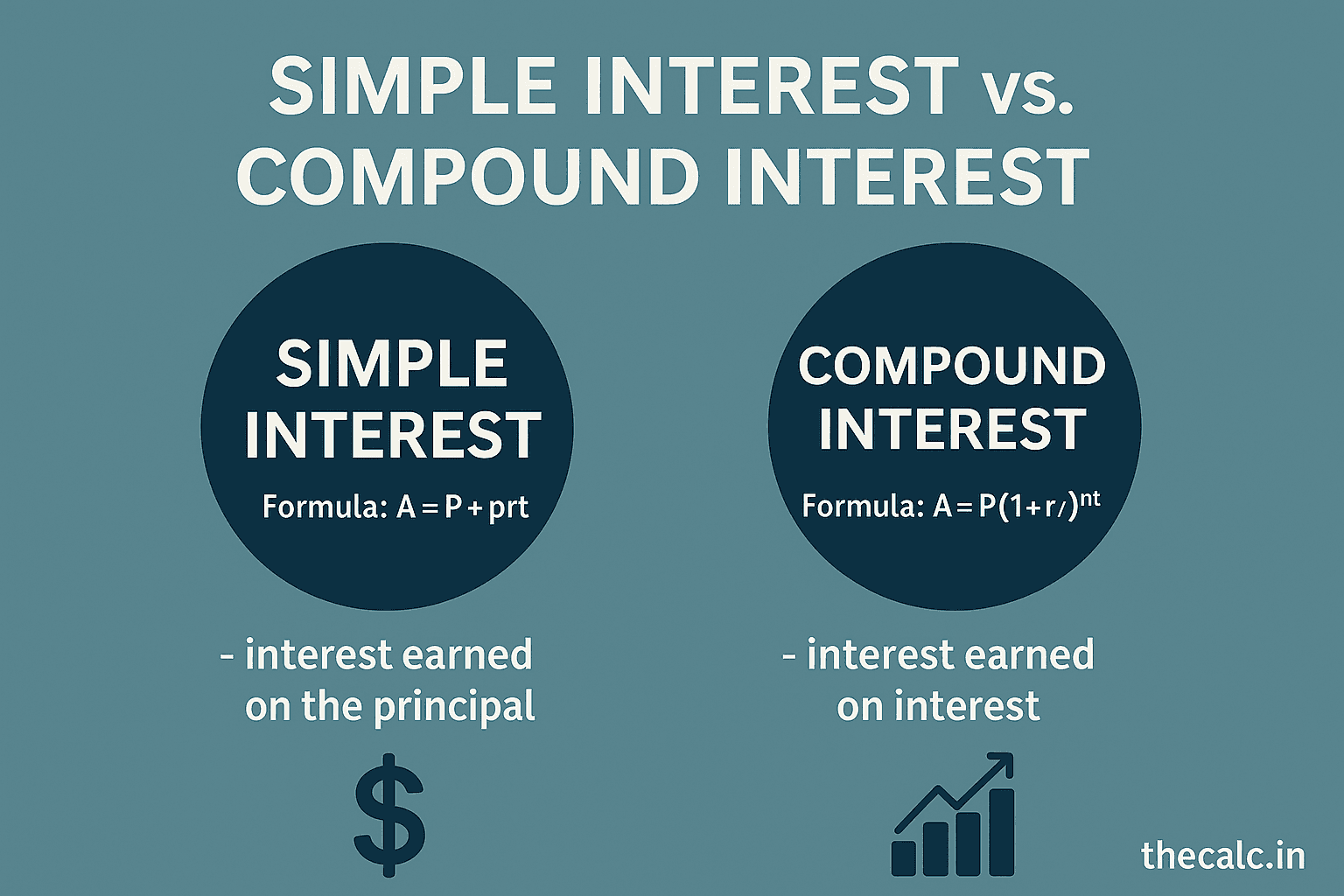

Simple Interest is the easiest way to calculate interest on a principal amount. The interest is calculated only on the original sum (principal) for the entire period of the loan or investment, without considering any interest that accumulates on previously earned interest.

Simple Interest = (P × R × T) / 100

Where: Simple Interest, P = Principal, R = Rate of Interest (% per annum), T = Time (years)

- Easy to calculate and understand

- Commonly used for short-term loans, car loans, and some savings accounts

- Interest does not compound over time

🔄 What is Compound Interest?

Compound Interest is the interest calculated on the initial principal and also on the accumulated interest from previous periods. This means you earn "interest on interest," which helps your money grow faster over time.

Compound Interest = P × [ (1 + R/100)T - 1 ]

Where: Compound Interest, P = Principal, R = Rate of Interest (% per annum), T = Time (years)

- Interest is calculated on both principal and accumulated interest

- Common for fixed deposits, recurring deposits, and long-term investments

- Leads to faster wealth growth due to compounding effect

🧰 How the Simple Interest & Compound Interest Calculator is Useful

Manually calculating Simple Interest and Compound Interest can be tedious and prone to errors. Our Simple Interest & Compound Interest Calculator simplifies this process, providing you with instant and accurate results. Here's how it can help you:

- 🔹 Instant Calculations: Get immediate results for both Simple and Compound Interest.

- 🔹 Multiple Frequencies: Calculate interest for various compounding frequencies - annually, semi-annually, quarterly, or monthly.

- 🔹 Comprehensive Reports: View total interest earned, maturity amount, and year-wise breakdown of interest and principal.

- 🔹 Mobile-Friendly: Access the calculator on any device, optimized for both desktop and mobile views.

- 🔹 Free and No Sign-Up Required: Enjoy a completely free service without the need for registration or sign-up.

⚖️ Difference Between Simple Interest and Compound Interest

| Feature | Simple Interest | Compound Interest |

|---|---|---|

| Interest Calculation | Only on principal | On principal + accumulated interest |

| Growth Rate | Slower | Faster (due to compounding) |

| Common Uses | Short-term loans, car loans | FDs, RDs, long-term investments |

| Formula | Simple Interest = (P × R × T) / 100 | Compound Interest = P × [ (1 + R/100)T - 1 ] |

🧮 Examples of Simple Interest and Compound Interest

Simple Interest = (10,000 × 10 × 3) / 100 = ₹3,000

Total amount after 3 years = ₹13,000

Compound Interest = 10,000 × [ (1 + 10/100)3 - 1 ] = 10,000 × (1.331 - 1) = ₹3,310

Total amount after 3 years = ₹13,310

🛠️ About the Simple Interest & Compound Interest Calculator

Calculating interest manually can be tedious and error-prone. That's why we built the Simple Interest & Compound Interest Calculator at TheCalc.in.

- Calculate both Simple Interest and Compound Interest instantly

- Supports different compounding frequencies (yearly, half-yearly, quarterly, monthly)

- Shows total interest, maturity amount, and year-wise breakdown

- Mobile-friendly and ad-free experience

- Free to use—no sign-up required

📝 Conclusion

Understanding the difference between Simple Interest and Compound Interest is crucial for making smart financial decisions. Use our Simple Interest & Compound Interest Calculator on TheCalc.in to compare, plan, and grow your money with confidence!